Condo Insurance in and around Edmond

Condo unitowners of Edmond, State Farm has you covered.

Protect your condo the smart way

Your Search For Condo Insurance Ends With State Farm

When considering different providers, liability amounts, and savings options for your condo insurance, don't miss checking out the options that State Farm offers. These coverage options can help protect not only your unit but also your personal belongings within, including pictures, cookware, shoes, and more.

Condo unitowners of Edmond, State Farm has you covered.

Protect your condo the smart way

Agent Dennis Chaumont, At Your Service

It's no secret that life is full of surprises, which is all the more reason to be prepared for the unexpected with condo unitowners insurance. This can include instances of liability or covered damage to your unit from water damage, a hailstorm or an ice storm.

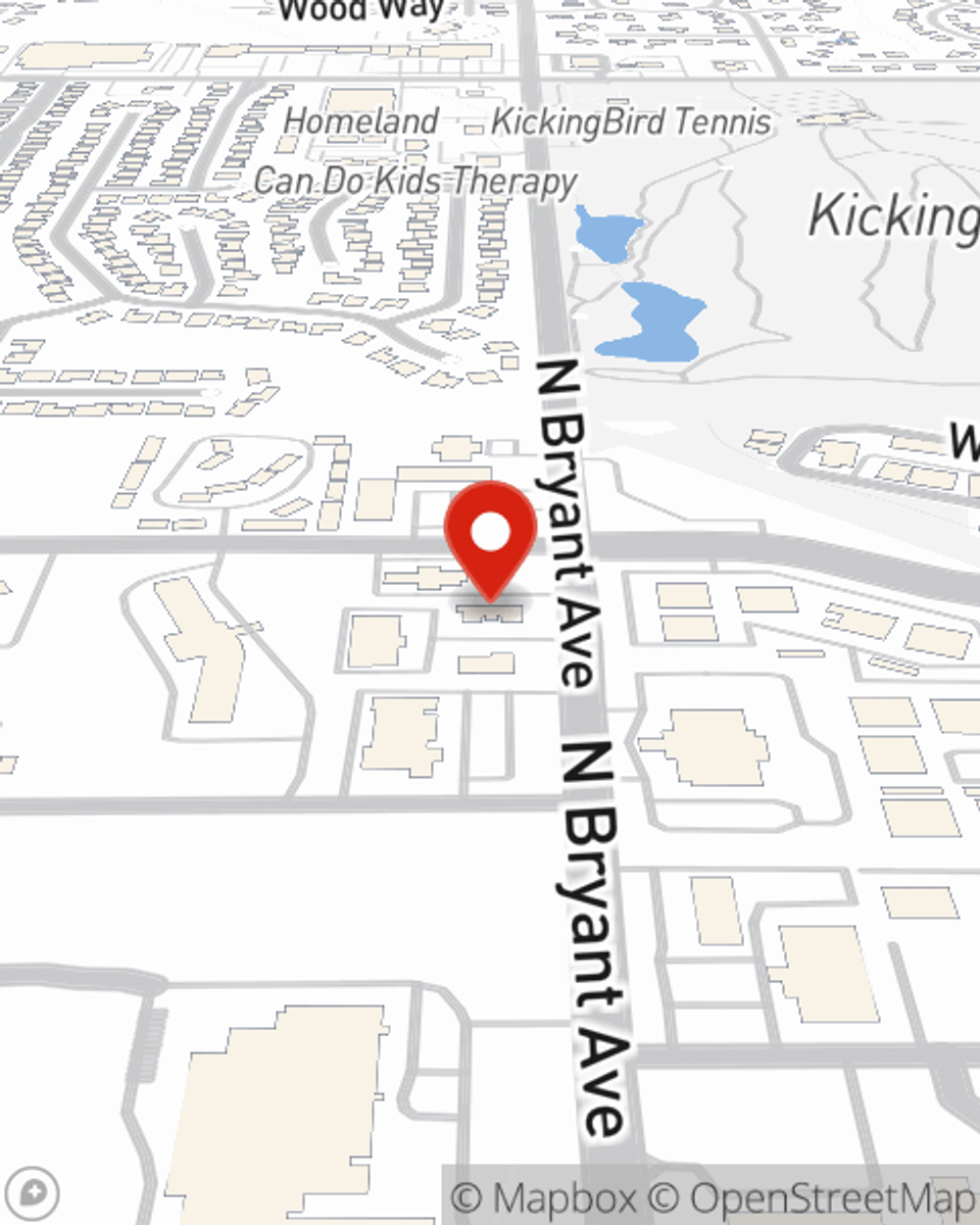

Intrigued? Agent Dennis Chaumont can help walk you through your options so you can choose the right level of coverage. Simply visit today to get started!

Have More Questions About Condo Unitowners Insurance?

Call Dennis at (405) 341-4581 or visit our FAQ page.

Simple Insights®

Should I pay off my mortgage before I retire?

Should I pay off my mortgage before I retire?

Retiring without mortgage payments could mean less debt and monetary worries in your retirement years. Here are a few tips to help.

How to spot a roof leak and what to do if you have one

How to spot a roof leak and what to do if you have one

From mold on the roof to missing shingles, learn how to find roof leaks and know what to do.

Dennis Chaumont

State Farm® Insurance AgentSimple Insights®

Should I pay off my mortgage before I retire?

Should I pay off my mortgage before I retire?

Retiring without mortgage payments could mean less debt and monetary worries in your retirement years. Here are a few tips to help.

How to spot a roof leak and what to do if you have one

How to spot a roof leak and what to do if you have one

From mold on the roof to missing shingles, learn how to find roof leaks and know what to do.